INTEGRITY

OUR VALUES

INNOVATION

IMPACT

EXCELLENCE

PARTNERSHIP

WHO WE ARE

Founded in 2014, Investor Capital Fund Management was born out of a simple but powerful conviction: that every Ghanaian from the ordinary farmer and street trader, to the pensioner, professional, rural bank, and credit union deserves financial products that truly work for them.

Our founders observed critical gaps in the industry. Too often, pensioners retired without receiving the benefits they had worked a lifetime for. Too many individuals and businesses were unable to properly assess their net worth and asset value, because financial tools were fragmented and inaccessible. The market was filled with products that catered only to a privileged few, leaving behind the very people who needed them most the teacher, the nurse, the civil servant, the small rural bank, the credit union, and the village savings

and loans association.

Investa Capital was established to change this narrative.

We are guided by a clear mission: to treat every client with the respect, transparency, and diligence they deserve, while creating wealth solutions that are inclusive, innovative, and life-changing. Over the years,

we have grown into a trusted fund management company that not only manages money, but also empowers people to understand and take control of their financial future.

At Investa Capital, we believe wealth creation should not be a privilege reserved for a few. It must be accessible, practical, and rewarding for all from the bustling streets of Accra to the rural communities of the Upper East. Our journey has been shaped by the lives we touch: the pensioner who can retire with dignity, the credit union that can access liquidity to serve its members, the worker who can finally measure their net worth, and the everyday Ghanaian who can now say with confidence, “I am building wealth.”

This is who we are. This is Investa Capital Fund Management.

Building Wealth. Securing Futures.

WHO WE SERVE

At Investa Capital Fund Management, we design investment and financing solutions that are inclusive, adaptable, and tailored to meet the needs of a diverse range of clients. Our goal is to empower individuals and institutions with the tools to grow, preserve, and strategically deploy capital for both personal and organizational success.

INVESTA CAPITAL FUND MANAGEMENT TEAM

Ambassador Emmanuel O. Darko brings nearly five decades of pioneering leadership in cooperative finance, governance, and financial inclusion to his role as Board Chairman of Investa Capital Fund Management. Recognized globally as a transformational leader in the credit union movement, he provides Investa Capital with unmatched credibility, governance depth, and strategic vision as the firm positions itself among the leading fund management companies in Ghana and Africa.

As former Chief Executive Officer of the Ghana Cooperative Credit Unions Association (CUA), Ambassador Darko was instrumental in strengthening Ghana’s cooperative finance system, ensuring sound regulation, building financial discipline, and driving sustainable growth for millions of members nationwide.

His international reputation was cemented when he was appointed Goodwill Ambassador for the African Confederation of Cooperative Savings and Credit Associations (ACCOSCA) in 2015, serving over 20 African countries in advancing cooperative development, financial literacy, and inclusive finance.

In 2025, he became only the third African to receive the World Council of Credit Unions (WOCCU) Distinguished Service Award, the highest individual honor in the global credit union system — a recognition of his extraordinary contributions to global cooperative finance.

Holding an MBA in Finance and a B.Sc. in Business Administration (Marketing), Robert blends deep financial expertise with strong marketing insight. This dual background enables him to design products that are not only technically sound but also marketable and accessible to diverse client groups.

He has held senior leadership roles, including Executive Director of The Joseph Assignment Global Initiative – Ghana, where he administered large-scale development programs, policy-aligned project frameworks, audits, and compliance structures. He also served as Lead Project & Administrative Officer (Ghana) for New Faith Ghana, managing nonprofit operations, personnel, and resource allocation.

Academically, Nii Ofoli holds a Bachelor’s degree in Business Studies (Human Resource Management) and a Bachelor’s degree in Development Communication, as well as a Master’s degree in Development Studies and a Master’s degree in Climate Change & Sustainable Development. He also holds advanced certifications in Risk and Advanced Management (Canada), Project Management, and Management & Corporate Governance Consulting — giving him a strong foundation to bridge finance, development, and institutional governance.

He holds an M.Sc. in Finance (Distinction) from Coventry University, UK, a BA in Economics from the University of Ghana, and a Certificate in Investment from the Ghana Stock Exchange.

With over a decade of experience spanning academia, research, and community development, he has lectured in economics, investment fundamentals, and corporate finance at Regentropfen College of Applied Sciences and advised students on financial literacy at Coventry University. He has also contributed to grassroots financial education as a radio panelist and volunteer teacher.

As a Board Member of Investa Capital Fund Management, Apatabire provides strategic oversight in fund governance, risk management, and financial structuring. His strong research background in mutual fund performance and asset pricing, combined with his leadership in student and community organizations, strengthens Investa Capital’s commitment to accountability, innovation, and inclusive financial solutions.

WHY CHOOSE US

TRUST

INNOVATION

CLIENT-CENTERED

PROVEN IMPACT

COMPLIANCE

CLIENT TESTIMONIALS

INSIGHTS & NEWSROOM

FREQUENTLY ASKED QUESTIONS

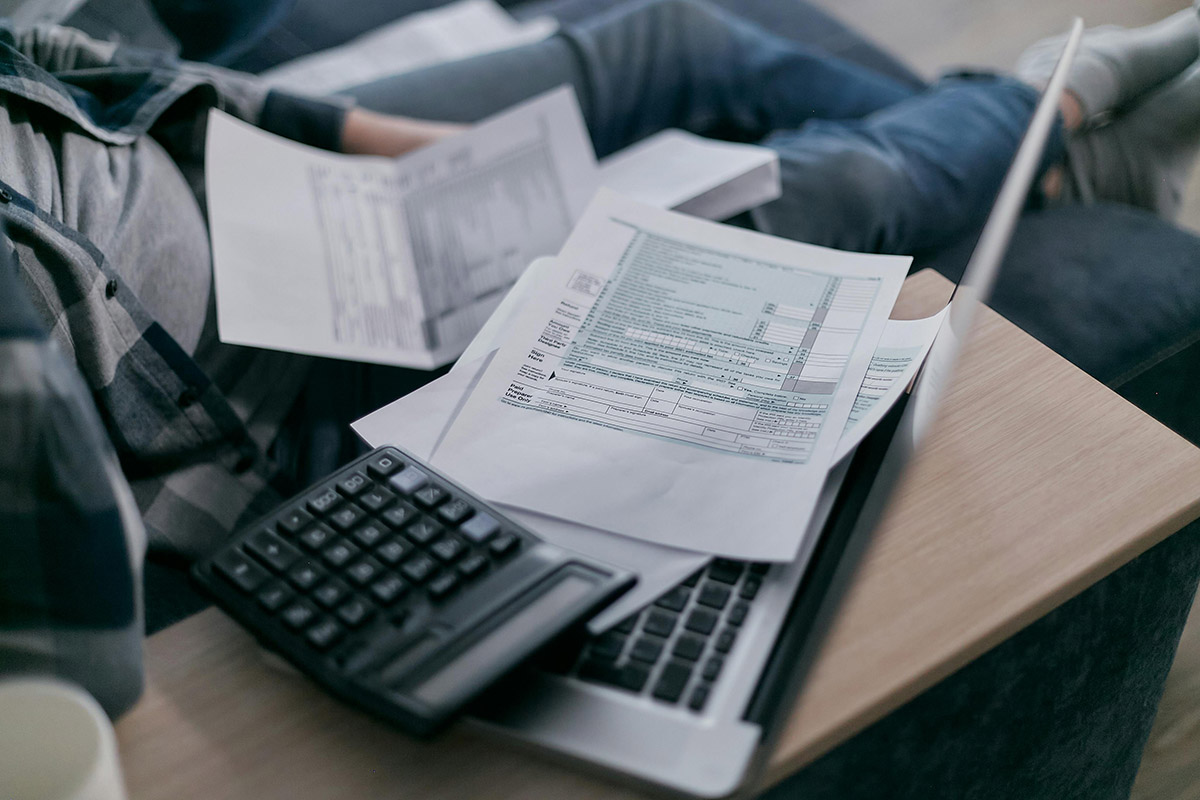

HOW SAFE IS MY MONEY?

Your money is held with trusted, regulated custodians, separate from the firm’s own assets. While all investments involve some level of risk, we focus on protecting your capital through diversification, careful monitoring, and long-term strategy. You always have full visibility into where your money is and how it’s performing. Our goal is to keep your investments safe while helping them grow responsibly.

WHAT IS COMMERCIAL PAPER?

Commercial Paper (CP) is a short-term, unsecured debt instrument issued by corporations, financial institutions, and sometimes governments to meet immediate funding needs such as working capital or liquidity management.

-

Maturity: Typically ranges from a few days up to 270 days.

-

Issuer: Generally issued by highly rated companies with strong credit profiles, since it is not backed by collateral.

-

Denomination: Usually issued in large denominations, making it primarily accessible to institutional investors.

-

Use of Proceeds: Commonly used to finance payroll, accounts payable, inventories, or other short-term liabilities.

-

Attractiveness: Offers investors a relatively low-risk, interest-bearing alternative to bank deposits or Treasury bills, often with slightly higher yields.

In essence, CP is a key money market instrument that provides issuers with flexible, low-cost funding and gives investors a liquid, short-term investment option.

HOW DO I WITHDRAW?

You can request a withdrawal at any time through contacting our client services team. Once your request is submitted, we’ll process the funds back to your linked bank account or preferred payment method on file. Processing times may vary depending on your bank

HOW DO PENSIONS WORK?

A pension is a retirement plan designed to provide individuals with a steady income after they stop working. Employers, employees, or both contribute funds into the pension plan over the course of an employee’s career. These funds are then invested and managed with the goal of generating returns to support future payouts.

COMPLIANCE & GOVERNANCE

INVESTA CAPITAL IS LICENSED AND REGULATED BY THE SEC GHANA.

OUTLINE COMPLIANCE AND RISK MANAGEMENT FRAMEWORKS.

LET’S GROW TOGETHER, START YOUR INVESTMENT JOURNEY WITH INVESTA CAPITAL TODAY

CONTACT US

Tel: +233 (0) XXX XXX XXX

Email: info@investacapital.com.gh

Head Office: Accra, Ghana

LET'S TURN YOUR FIRST CEDI INTO MILLIONS.

TALK WITH OUR TEAM

DYNAMIC FOOTER WILL BE HERE

SECURED BY SSL

PRIVACY & POLICY

TERMS & CONDITIONS

ALL RIGHTS RESERVED BY INVESTA CAPITAL FUND MANAGEMENT 2025 ©